njtaxation.org property tax relief homestead benefit

The NJ Homestead Benefit reduces the taxes that you are billed. Homeowners Relief Program is Giving 3708 Back to HomeownerCheck Your Eligibility Today.

File Online or by Phone.

. The automated telephone filing system and this website will be. The following chart shows the mailing schedule for the 2018 Homestead Benefit filing information packets. The system will also indicate whether the benefit was applied to your property tax bill or issued as a check or direct deposit to your.

If you answer yes and later sell your home after filing this application the only way to receive your 2018 Homestead Benefit is to negotiate it at the closing of your property sale. The filing deadline for the latest Homestead Benefit Application - Tax Year 2018 - was November 30 2021. Homeowners who indicated when filing that they no longer own.

The NJ Division of Taxation mailed New Jersey homeowners filing information for the 2018 Homestead Benefit in October. Check the Status of your Homestead Benefit. The program rules and online application are found at njgovtaxation click on Property Tax Relief Programs.

If you were not a homeowner on October 1 2017 you are not eligible for a Homestead Benefit even if you owned a home for part of the year. The benefit amount has not yet been determined. Homestead Benefit Online Filing.

You can get information on the status amount of your Homestead Benefit either online or by phone. Pass-Through Business Alternative Income Tax PTEBAIT Sales and Use Tax. Check the Status of your Homestead Benefit 2018 Homestead Benefit.

Property Tax Relief Programs. Division of Taxation. We recommend that you do not include your full social security number.

Search here for information on the status of your homeowner benefit. 9-1-1 System and Emergency Response Fee. Mailing Expected to Begin.

Prior Year Homestead Benefit Information. If a benefit has been issued the system will tell you the amount of the benefit and the date it was issued. If you did not receive a 2018 Homestead Benefit mailer and you owned a home in New Jersey on October 1 2018 that was your main home call the number above for help.

You are not eligible unless you are required to pay property taxes on your home. We do not send Homestead Benefit filing information to homeowners whose New Jersey Gross Income for the application year was more than the income limits established by the State Budget. Check or Direct Deposit.

Tenants The amount appropriated for property tax relief programs in the State Budget does not include funding for 2018 tenant rebates. If you filed a 2017 Homestead Benefit application and you are eligible for the same property see ID and PIN. If you answer Yes to this question the benefit will reduce the tax bill of the person who owns the property on the date the benefit is paid.

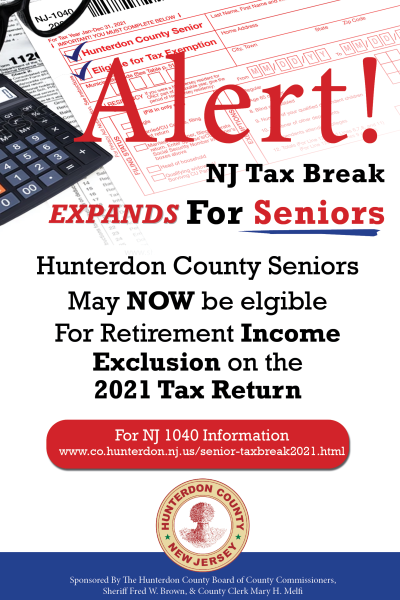

They are separate property tax relief programs with different eligibility requirements different applications and different filing schedules. The home was subject to local property taxes and the 2017 property taxes were paid. 75000 for homeowners under age 65 and not blind or disabled.

Credit on Property Tax Bill. When you report your property taxes paid you already account for this benefit. Ad 2022 Homeowner Relief Program is Giving a One Time 3627 StimuIus Check.

1-877-658-2972 When you complete your application you will receive a. E-mails sent to this address are not sent through a secure server. A variety of tax exemptions are available for the elderly disabled and veterans.

The total amount of all property tax relief benefits you receive Homestead Benefit Senior Freeze Property Tax Deduction for senior citizensdisabled persons and Property Tax Deduction for veterans cannot be more than. And over the past five years the average New Jersey property-tax bill has increased by 563 easily swamping todays average Homestead benefits which are 526 for senior and disabled recipients and 412 for. Most recipients get a credit on their tax bills.

The average 2019 property tax bill in New Jersey is 9000. Office of the Taxpayer Advocate OTA PO. For most homeowners the benefit is distributed to your municipality in the form of a credit which reduces what you owe in property tax.

The State Budget requires that the benefit amount be calculated using 2006 property taxes Most homeowners will receive their 2016 benefit payment as a credit on a future property tax bill. 2018 Homestead Benefit payments should be paid to eligible taxpayers beginning in May 2022. Amounts you receive under the Homestead Benefit Program are in addition to the States other property tax relief programs.

The Homestead Exemption Program delays the payment of property taxes for single members earning less than 16000 and joint members earning. Online Inquiry For Benefit Years. Residents should not confuse the Homestead Benefit Program with the Senior Freeze Property Tax Reimbursement Program.

Moreover the average property-tax bill has increased by more than 40 since 2006 according to the states most recent tax data. Phil Murphys proposed 324 billion spending plan includes 275 million for the property tax relief program which lowers tax bills for about 580000 seniors disabled or low-income. The Homestead Benefit program provides property tax relief to eligible homeowners.

Your tax collector issues you a property tax bill or advice copy reflecting the amount of your benefit. Income Tax Residents Only Partnerships. Email Delivery Expected to Begin.

Because the benefit is no longer handled as a rebate it is no longer accounted for on your federal or NJ tax returns. To file an application by phone1-877-658-2972. Applicants can receive benefits under both programs if they qualify.

Property Tax Relief Programs. The New Jersey Homestead Benefit Program provides property tax relief to eligible homeowners in the form of a property tax credit that the state pays to municipalities on behalf of eligible homeowners to reduce their tax liability.

Nj Property Tax Relief Program Updates Access Wealth

Property Tax Rebates Recoveries Ptr Homestead Benefit Federal

State Homestead Rebate Applications In The Mail Due November 30 News Tapinto

Memoli Company Pc Home Facebook

Property Tax Rebates Recoveries Ptr Homestead Benefit Federal

Property Tax Deduction Credit Eligibility Requirements All The Following Must Be Met You Must Have Been Domiciled And Maintained A Principal Residence Ppt Download

Property Tax Relief Programs West Amwell Nj

Property Tax Rebates Recoveries Ptr Homestead Benefit Federal

Property Tax Relief Programs West Amwell Nj

Property Tax Rebates Recoveries Ptr Homestead Benefit Federal

Property Tax Deduction Credit Eligibility Requirements All The Following Must Be Met You Must Have Been Domiciled And Maintained A Principal Residence Ppt Download

Property Tax Deduction Credit Eligibility Requirements All The Following Must Be Met You Must Have Been Domiciled And Maintained A Principal Residence Ppt Download

Property Tax Rebates Recoveries Ptr Homestead Benefit Federal

Property Tax Rebates Recoveries Ptr Homestead Benefit Federal

Property Tax Rebates Recoveries Ptr Homestead Benefit Federal